Why is online grocery shopping still so hard?

We are now almost nine months into the pandemic. While we have seen meaningful growth in online grocery there has not been real progress to enhancing this experience for the consumer. As the second wave of infections has swept across the United States, more households are being affected by stay at home orders, curfews and store closures, and, with winter upon us, these same households will have limited outdoor seating possibilities.

By most accounts, this should mean that more people are using either Click & Collect or Delivery options for their grocery shopping needs, meaning more households will be, and have been using online grocery platforms to select and build their baskets both large and small.

However, the unfortunate circumstance is that many households are still operating off reduced or very limited income because of the underlying economic conditions. Living in Washington, D.C., I set out to understand what are the cheapest options among some of the largest grocery store chains in the area by researching across a number of channels and recreating the same basket of items across them.

While gathering the data, it was readily apparent that the user experience may actually be more critical than the results of the pricing analysis. It’s important to highlight such areas of the platform as it is easy to overlook the finer details of the experience as overall channels grow at a massive pace. For many retailers, the focus in online grocery has been the profitability of the fulfillment. But while this is a major part of the equation, will these operational changes still be relevant if consumers are grow unsatisfied with the experience and the volume dissipates? The hard question that all grocery stores must continually ask themselves is this—When people are not forced to use online grocery to the extent that they have during this pandemic, will they still utilize it?

Navigation

In-store navigation is cornerstone of a retailer’s strategy in physical retail. They carefully select and place categories in strategic areas throughout the store in order to not only maximize traffic for all standard basket sizes and compositions but also to increase the potential that shoppers enlarge their expected baskets with complimentary goods and spontaneous buys. Not to mention that thoughtfully placed categories guide the customer through their trip in a way that is intuitive.

In theory, the online environment allows retailers to customize this journey for every individual, reducing friction from ideation to purchase. And that’s exactly why it was so frustrating for me to complete this research. Across online platforms, I found searching for items to be tedious, time consuming, and, frankly, I wanted to give up each time. None were actually tailored to my user profile nor were they set up for me to conduct a basic search.

Let’s take for example the private label equivalent for Oreos. In the physical store, we would find these products (if the retailer has developed them - which any retailer that has invested in their Private Label department would definitely have completed) either directly next to the national branded item or in block/section with the other private label items next to their nationally branded equivalents. While “private label” is a term that most consumers are well versed in, online search engines seem to not be. In the course of my search, few of them even recognized “private label cookies,” let alone off-brand Oreos.

Retailers on third party platforms should be finely attuned to how your products are displayed to the online customer. Customers should not have to sacrifice experience of understanding what they are buying when they use these services. A little product management can go a long way.

Anecdotally, every third item used in my pricing research either lacked a thumbnail photo or had an indecipherable product title. Packaging is especially important with private label items since consumers often make a face-value decision on its quality from the packaging alone. So without seeing what the private label product looks like online, how much less likely is a shopper to buy? From a retailer perspective, private label, which often has a higher profit margin, can and should be viewed as an important lever to improve these fulfillment channels profitability. A $100 basket of private label profit margins vs. nationally branded profit margins could increase the profitability of the basket by more than 200%. Add in the cost of fulfillment, and they could could turn an overall net-negative profit basket to a net-positive one.

A simple yet seemingly underutilized function in search is to be able to sort items by their net unit price. From a retailer’s perspective this could be beneficial as larger pack sizes often have a lower unit price which means that they will be brought to the top of the page and could lead to consumers trading up. However only Peapod - Giant and Instacart offered this feature. Peapod’s sort functionality was very comprehensive and could easily allow for varying consumers to be able to sort based on what was most important to them at that point in time.

On the opposite end of the spectrum, Shipt did not offer any sort functionality at all which made looking for items increasingly frustrating.

Amazon was the only option to sort by Customer Review which will be very helpful as social proof is an incredibly important part of the online customer decision making process. (Side note: the “Everything Store” only offers seven paper towel options through AmazonFresh in the DC Area.)

Lastly, ask any customer what they expect to find near the cash register in a store and you are guaranteed to hear some combination of candy, snacks, periodicals and soft drinks. For some this may be a time of joy, to reward their long journey carting their children through the store, to pick up a surprise for their loved one at home or just to brighten up their own day - so why is this not replicated in an online environment? One delivery option that introduce items in the checkout process was Amazon where a thoughtful selection of items was displayed in the load frame based on items that were trending locally and salty snack items among a few other categories.

Price

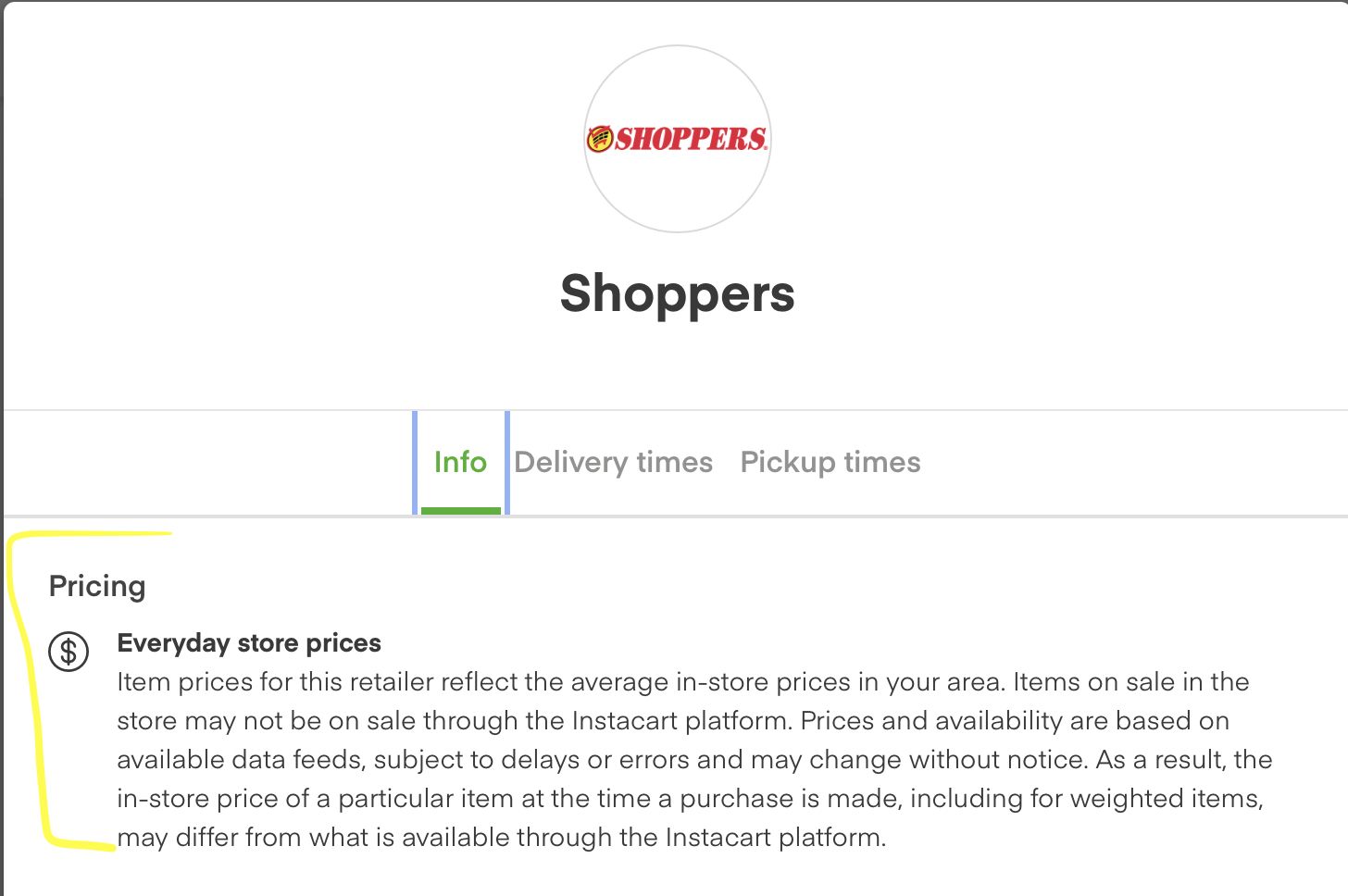

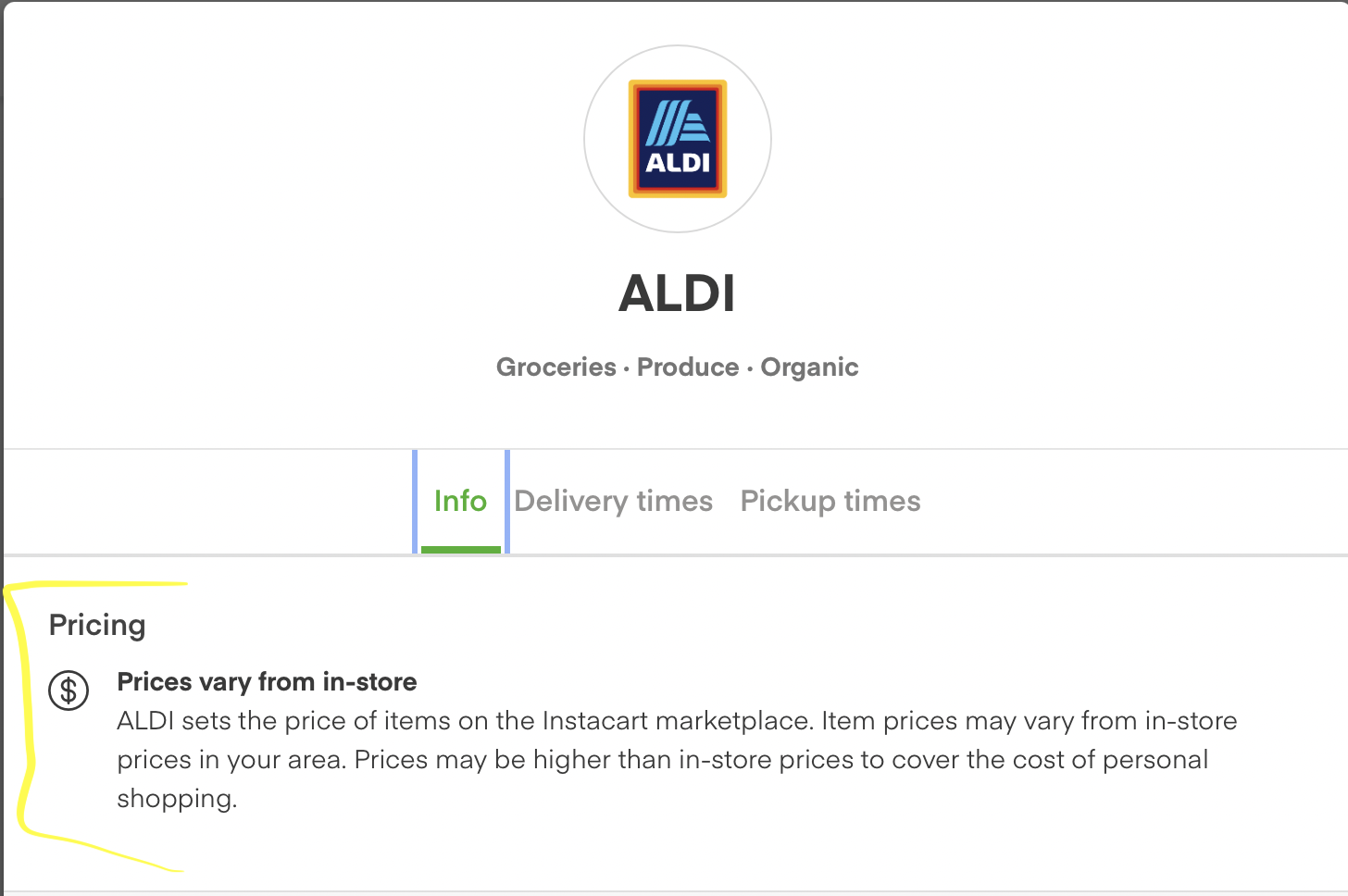

Pricing in Online Grocery is notoriously confusing. Some platforms/retailer websites have a markup on the in-store price of the product. Wonder why you don’t get your receipt when you order from Shipt or Instacart? It’s because they don’t want the consumer to see that there might be a difference. Not all retailers have price markups, and normally they are fairly straightforward about the fact that the prices may not match what you, as the consumer, are used to seeing in your local store. On Instacart, this information is displayed at the top of the page next to the retailer’s logo. Here’s two examples of same price in-store and online (Shoppers) vs. online markup (Aldi).

Shoppers Food has a notification showing that consumers will get ‘Everday store prices’ - meaning same price in-store.

More Info - shows that it is maybe not as straightforward as it originally seems. “..based on available data feeds, subject to delays or errors and may change without notice.”

Comparatively, Aldi displays a “View pricing policy”, which can be translated to some items will not match in-store pricing.

The fine print validates the above definition, clearly stating “Prices may be higher than in-store prices to cover the cost of personal shopping.”

Like similar Basket Price Analyses a set of target items were defined for the basket and a set of retailers/formats were chosen to complete the comparison. The purpose from the outset was to understand which major retailer/fulfillment channel combination could provide customers in this given zip code of DC the best prices on basic items. The retailers in focus were traditional grocery chains (Safeway, Giant, Harris Teeter, Shoppers, mass merchandisers (Walmart, Target), discounters (Aldi, Lidl) and, because they are the biggest online retailer, Amazon’s Fresh. The basket consisted of 60 household staples, items that are purchased frequently and have high dollar/traffic importance within a grocery store especially around the holiday season (read: bananas, milk, cheese, snacks, baking products). To select which item at each of the retailers to utilize the search methodology was to find the relative size first and then price per unit which inherently meant that almost all items in the comparison were private label. If the products that the retailer had were different from the size of the target item the price was equalized in order to be as objective as possible. The only branded item that was purposefully selected was Coca Cola 12 packs. The data was collected on the week of Nov. 22nd.

As stated above, finding these items was not always easy and, in some cases, took considerable attempts at varying the search query as well as utilizing the category hierarchy to find the appropriate comparison. My best guess to why this was so difficult was that private label items do not have the level of product detail depth that the search query algorithm was utilizing to produce results. Unfortunately for retailers, most shoppers will not persist to the extent or know how to navigate their product categories to find these products in the online platform.

Regardless, this was the result:

Unsurprisingly Aldi, Lidl and Walmart at the top of the list.

Overall the results were not game-changing and validated my original price perception of where these retailers are positioned among the affordable to expensive axis. The one result that I did find surprising is the difference in the total basket between the Shipt and Instacart platforms for some of the retailers. For example, Harris Teeter was $51.60 cheaper on Shipt than on Instacart. There could be any number of reasons for this ranging from employing different pricing strategies based on customer purchasing behavior on the given platform to not maintaining/updating their prices on these platforms.

Regardless, retailers overall should be aware and understand how these platforms compare not only against each other but also to their in-store price, even if it is difficult/time consuming for consumers to complete this comparison analysis as it will help build their brand trust with their shoppers.

An altogether different outcome from the analyses was that not all item’s price comparison fell where the retailer selling them fell in the total analysis. When you are delivering products to an address on Instacart it will show you prices of what seems to be the closest store that you have chosen to shop. For this zip code it means that your Wegmans order is coming from 14 miles away. Had you chosen Aldi, it would only be 6.7 miles away. For me, that was strange because the closest Aldi to the zip code 20009 is actually only about 4 miles away and probably indicative that Instacart is not shopping at that location.

I took a closer look at one comparison - Whole and 2% Gallon Milk from Wegmans and Aldi to help to try to explain the difference in price that was shown for the Whole Milk in the store list. Because Instacart doesn't tell you from which Wegman it is delivering relative to 20009 (the zip code used for the study) I found the 3 closest Wegmans:

Logically, they should be delivering from the closest Wegmans to the end destination, but, as you can see, 1 mile can mean more than an additional 10 minutes delivery time. There is most likely also some logic applied to where the groceries would come from based on the number of available platform shoppers in the nearest areas, 20706 (McLean, VA) and 22102 (Lanham, MD).

I know that there are Aldis closer to these zip codes than the one that they are delivering from to a 20009 address and changed the delivery zip code to match the zip codes of the Wegman’s to see if there was a price difference.

And the difference in the best price for these items by Delivery Zip Code:

In the study, Wegmans is cheaper by the first row of the above table. But in Lanham, Aldi is actually $0.20 cheaper. When stores have localized pricing it can make a difference to the final comparisons based on where the shopper is located and what the closest retailer’s pricing are around them. While this could be used to construe the lack of relevancy of this study across the total DMV area, it does help to highlight the lack of transparency in retail prices for important household items. Being 20 minutes in one direction could mean that you could pay $1.50 more ($3.89 vs. $2.39, 63% more!) for the same gallon of milk from McLean to Lanham. This also highlights the importance for consumers to spend the time and figure out if where they are shopping is the best for their budget - especially on the core items like milk, eggs, butter, bananas.

What’s the takeaway here? Consumers should invest the time in researching and comparing prices as it can equate to be a big difference when you multiply a weekly or even monthly trip cost, times the number of times a household purchases per year. Take for example the difference for Harris Teeter, monthly trips multiplied by $50 is $600 over the course of a year. While these prices will definitely change - next week Lidl or Aldi could have lower prices than Walmart, Harris Teeter could price match across platforms, etc. - the important consideration is the consumer. Retailers focusing on making this everyday task easier to complete online can mean alleviating even some of these pain points and will go a long way to build brand trust and ultimately loyalty in the long run with their consumers.